Shares in Symphony Environmental Technologies (28p) jumped on the back of an announcement that the company’s antimicrobial d2p masterbatches performed well in tests to investigate whether they are virucidal. This means that the products may be used as potential virucidal agents against coronavirus. Clearly this has provided the company with a significant boost in the near term and we believe that there is a good chance that the rally in the share price will continue.

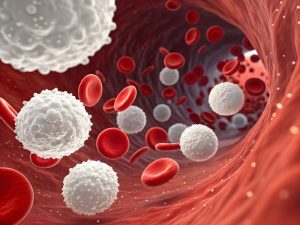

In July the company announced that Eurofins Laboratories had tested Symphony’s d2p masterbatch incorporated in a polyolefin film against the bovine form of coronavirus, in accordance with International Standard, ISO 21702-2019. This found a virus reduction of 99.84% in 24 hours. There have now been further coronavirus tests at 1, 2 and 24 hours by The Institute of Biology at Unicamp University in Sao Paolo State, Brazil. A report concluded that the products were shown to be virucidal and recommended the use of the products as potential virucidal agents against coronavirus. It was demonstrated that the active compound was active towards the virus only and would not harm the host cells. The technology is embedded in the plastic itself, which means that d2p provides protection for the lifetime of the plastic product. The company plans to move the product quickly into global sales operations.

Symphony has also announced interim results for the first half of 2020. In the six months to 30 June 2020 revenues increased by 17% to £4.8m (2019: £4.1m), resulting in a profit of £18k versus a loss of £86k in the same period a year earlier. Net cash was £0.29 at the period end. Despite the impact of Covid-19, the company has continued to invest in product development, regulatory advice and government lobbying, together with technical support at broadly the same levels as the first half of 2019.

There could be further positive announcements in the not too distant future. Any news on sales of the product would probably put upward pressure on the share price. The recent news may also be digested more slowly by some potential investors so for those willing to take a calculated risk, now looks a good time to jump in. We rate the shares as a SPECULATIVE BUY.